santa clara county property tax collector

An escape assessment is a correction to a personal propertys assessed value that the Assessors Office of the County of Santa Clara did not add to any prior years Annual Unsecured. Office of the Clerk of the Board of Supervisors.

22 reviews of Santa Clara County Tax Collector Well - what do you expect from a county office.

. Santa Clara County collects on average 067 of a propertys assessed fair market value as property tax. Last Day to file Business Property Statement without 10 Penalty. Frequently Asked Questions FAQs CA Code of Regulations Title 18 Chapter 1 Subchapter 3 Article 1.

Save time - e-File your Business Property Statement. Due Date for filing Business Property Statement. Ad Find Santa Clara County Online Property Taxes Info From 2021.

Saturday Jun 4 2022 656 AM PST. By using this service in any form the upper agrees to identify and hold harmless the County of Santa Clara and anyone involved in storing retrieving or displaying this information for any damages of any type that may be caused by retrieving this. Scheduled Downtimes Secured Property Search.

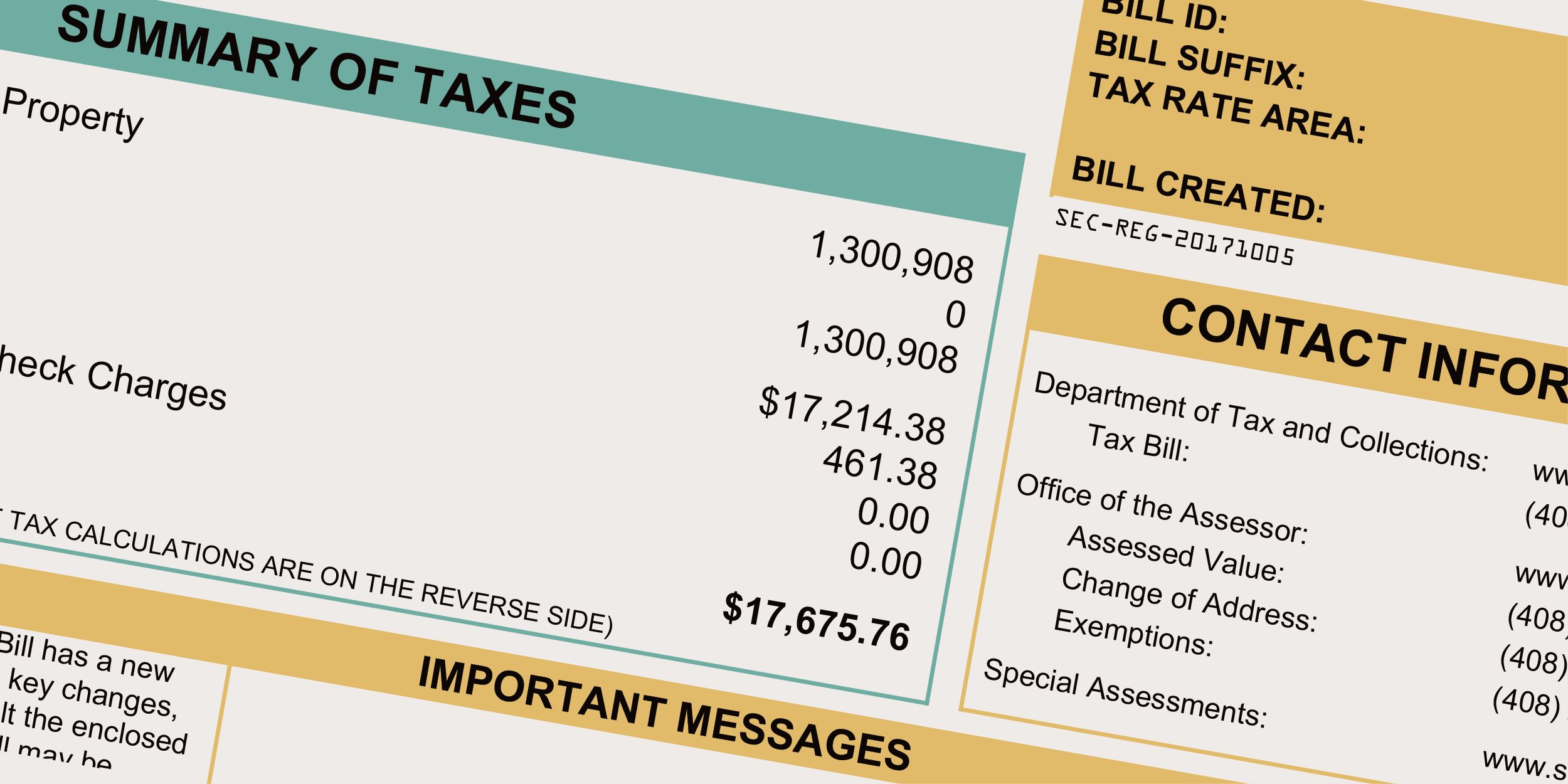

The tax rate itself is limited to 1 of the total assessed property value in addition to any debts incurred by bonds approved by voters. Santa Clara County has one of the highest median property taxes in the United States and is ranked 38th of the. CA State Board of Equalization Publication 29.

Receive Santa Clara Cty. In order to record a map for a parcel split with the Clerk-Recorders Office a Tax Clearance Certificate must be issued by the Office of the Clerk of the Board. You can call the Santa Clara County Tax Assessors Office for assistance at 408-299-5500.

The Santa Clara County Assessors Office located in San Jose California determines the value of all taxable property in Santa Clara County CA. In order to obtain one our office must issue a Tax Clearance Letter that clears the parcel of all outstanding taxes. ---- DISCLAIMER ----This search site is provided as a service to our customers.

View and pay for your property tax billsstatements in Santa Clara County online using this service. And reconciliation of the extended tax roll prior to certifying to the tax collector for tax bill printing mailing and collecting. Emailed and got a reply within a couple of.

Parcel Maps and Search Property Records. County of Santa Clara. Click here to contact us.

Stone says hes returned 232 million of unspent money in his budget to the county general fund. Enter Property Address this is not your billing address. Santa Clara County Apportionment and Allocation of Property Tax Revenues -1- Audit Report The State Controllers Office SCO audited Santa Clara Countys process for apportioning and allocating property tax revenues to determine whether the county complied with California statutes for the period of July 1 2016 through June 30 2019.

Department of Tax and Collections. According to Stone the countys assessment roll has increased 402 since he was first elected in 1995 growing from 150 billion a year to 575 billion in 2021. Office of the Tax Collector.

Currently the average tax rate is 079. The Tax Collector bills and collects the taxes and reports the. 00073 of Asessed Home Value.

Some property andor parts thereof may be subject to a special exemptionsuch as those for veterans or non-profit organizations like churches or hospitals. Santa Clara County California. The Assessor is responsible for establishing assessed values used in calculating property taxes and maintaining ownership and address information.

Business Property Statement Filing Period. When contacting Santa Clara County about your property taxes make sure that you are contacting the correct office. The Assessors Office allows residents to view free of charge basic information about properties in Santa Clara County such as assessed value assessors parcel number APN document number property address Assessor parcel maps and other information.

During that same period the assessors office has only grown by seven employees. 00114 of Asessed Home Value. On 4915 checked on line and the tax payment is not showing.

2022 County of Santa Clara. If you have documents to send you can fax them to. 12345678 123-45-678 123-45-678-00 Submit.

Click here to register it now. To pay Property taxes for Secured property you will need your Assessors Parcel Number APN or. CA State Tax Board of Equalization Property Tax Rules.

They are a valuable tool for the real estate industry offering. Find Santa Clara County residential property tax assessment records tax assessment history land improvement values district details property maps tax rates exemptions market valuations ownership past. All data contained here is subject to change without notice.

Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. They are maintained by various government offices in Santa Clara County California State and at the Federal level. You can pay tax bills for your secured property homes buildings lands as well as unsecured property businesses boats airplanes.

Property Records by Just Entering an Address. This information is available on-line by. Remember to have your propertys Tax ID Number or Parcel Number available when you call.

Free Santa Clara County Assessor Office Property Records Search. 1555 CASTILLEJA Submit-OR-Enter Property Parcel. See reviews photos directions phone numbers and more for Santa Clara County Tax Collector locations in Arlington Heights IL.

The Controller-Treasurers Property Tax Division allocates and distributes the taxes to the appropriate jurisdictions countywide. Effective tax rate Santa Clara County. Enter Property Parcel Number APN.

1 2022 - May 9 2022. 00076 of Asessed Home Value. The median property tax in Santa Clara County California is 4694 per year for a home worth the median value of 701000.

The Department allocates and distributes property taxes accurately and timely to taxing entities including the County school districts cities and special districts. Property tax due 41015 - went IN PERSON on 4615 with CASH and paid and got a stamped receipt. Send us an Email.

They have no incentive to do a better job. A fee of 50 is charged per parcel.

Info Santa Clara County Secured Property Tax Search

Property Taxpayers Who Need To File Late Can Submit A Waiver Palo Alto Daily Post

Santa Clara Shannon Snyder Cpas

Santa Clara County Ca Property Tax Search And Records Propertyshark

Understanding California S Property Taxes

Warning About Deceptive Tax Lien Mailer Santa Clara County Sheriff Mdash Nextdoor Nextdoor

Property Taxes Department Of Tax And Collections County Of Santa Clara

Property Taxes Department Of Tax And Collections County Of Santa Clara

Santa Clara County Property Value Increases In 2021 San Jose Spotlight

Property Taxes Department Of Tax And Collections County Of Santa Clara

Property Tax Email Notification Department Of Tax And Collections County Of Santa Clara

Info Santa Clara County Secured Property Tax Search

Santa Clara County On Twitter Sccgov Dept Of Tax And Collections Issues Announcement About Prepayment Of Propertytaxes Accepting Current Years S 2nd Installment Due April 10 2018 But Not Prepayment Of Future 2018 2019